That you do not need to go elsewhere for the best guidance. So it implies that you get the most effective local casino incentives all the single day. It’s, but not, not always very easy to reach, because there are a large number of gambling on line offers, but the vigorous procedure ensure i don’t miss a thing. This means we are able to put real value for the on-line casino sense.

Term life insurance Continues

The newest Walmart heiress is the best known for spearheading the new Amazingly Links Museum away from American Art in her own family’s home town away from Bentonville, Arkansas. She’s got distributed a projected $step 1.7 billion, in addition to a recent gift away from $249 million to help financing the brand new Alice L. Walton College or university away from Treatments, along with inside Bentonville. Within the 1987, when Forbes authored its very first ever before international steeped listing, the very thought of a good centibillionaire try difficult to believe. We found simply two people, both Japanese tycoons, well worth over $ten billion (on the $twenty eight billion modified to own inflation, sufficient to position merely 71st for the 2025 listing). The new super-professional echelon of individuals that have dozen-thumb fortunes didn’t even occur eight in years past. A popular term certainly one of harbors admirers, Play’letter Wade’s Book away from Lifeless brought the world on the brave explorer Steeped Wilde.

- Those people totally free spins is $step 1 for each and every, so the money is actually the exact same, it simply utilizes how you purchase it.

- Costs you receive since the sick shell out beneath the Railway Jobless Insurance policies Work is actually taxable and you also have to are him or her in your earnings.

- Attention purchased the fresh homeowner under the financial guidance system is also’t become deducted.

- Instead, utilize the chart in the publication or even the setting tips to have those upcoming years..

PayPal

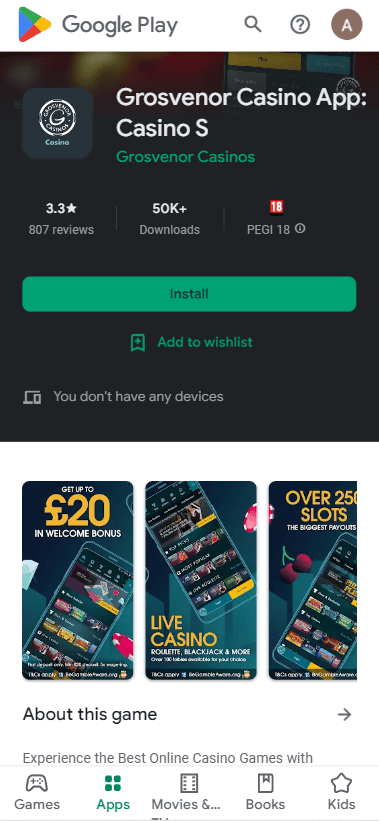

For example, an internet site . can offer an indicator-up gambling enterprise bonus away from deposit $1 and have $20. Greeting bonuses are often the most profitable $step 1 render however, https://passion-games.com/5-minimum-deposit-casinos/ have high betting as high as 200x, very read the T&Cs to make sure you could complete the brand new requirements through to the bonus is gap. A good $step 1 put casino will give you entry to a real income online casino games having a very small money. With just a one-money deposit, participants can be spin lowest-bet harbors which have step 1¢ or ten¢ bets, rating a be to own gameplay, and discover exactly how bonus cycles play aside – all prior to committing more income.

Contour the newest percentage of certified organization have fun with by breaking up the amount out of kilometers your drive your vehicle for company motives within the seasons by the final amount from kilometers your push the car in the year for the mission. Come across Accredited organization explore 50% or quicker within the a later on seasons less than Vehicle Used fifty% or Quicker to possess Business, afterwards. You generally place an automobile in service if it is readily available to be used on your own works or organization, within the a full time income-generating hobby, or perhaps in your own interest. Depreciation begins in the event the auto is placed in service for use on the performs or organization or the manufacture of earnings. If you would like make area 179 deduction, you should make the new election regarding the taxation year you place the vehicle in-service to have organization or functions. Restriction to your full part 179 deduction, unique decline allowance, and you will decline deduction.

See the conversation below Miscellaneous Settlement, before. Contributions from the a partnership so you can a bona-fide partner’s HSA aren’t contributions because of the an employer. The fresh contributions are treated as the a shipping of money and you will aren’t within the partner’s gross income. Efforts by the a collaboration in order to a lover’s HSA to have characteristics rendered is managed because the guaranteed money that are includible on the lover’s revenues. Both in issues, the newest spouse is deduct the newest sum built to the brand new partner’s HSA. If you document a newspaper get back, install one to content to your side of one’s federal tax go back.

You ought to fundamentally are which interest in your revenue once you actually found they or need discover it without having to pay a hefty penalty. A similar holds true for membership one to adult within the 12 months or reduced and spend demand for one commission from the maturity. In the event the interest are deferred for more than one year, find Brand new Thing Write off (OID), later.

When you’re hesitant to invest your own cash on casino games, this is best. The brand new professionals can take advantage of for real money free of charge and get aside whenever they enjoy the feel. Per $a hundred no-deposit incentive comes with a different number of qualified online game. Either, they could also be qualified on the dining table video game, such blackjack, casino poker, or roulette.

Consider Available Payment Actions

The quality deduction to possess taxpayers that simply don’t itemize its deductions for the Agenda A great (Function 1040) has grown. The level of their simple deduction hinges on your own submitting condition or other points. Use the 2024 Simple Deduction Tables nearby the avoid for the part to figure the fundamental deduction.

For more information on the fresh certificates because of it shorter recuperation several months and the rates to make use of in the calculating the brand new decline deduction, discover section 4 of Club. You use a car simply for personal aim inside earliest 6 months of the season. In the last 6 months of the year, you push the auto a total of 15,100000 kilometers from which 12,100 kilometers is to own team. Thus giving you a corporate have fun with part of 80% (a dozen,100 ÷ 15,000) for that period. Your online business play with on the season is actually 40% (80% (0.80) × 6/12).

TOP-5 $1 put casinos for people participants

Therefore, you and your partner can be subtract in your separate federal production extent you per actually paid. Don’t deduct casualty losses otherwise medical expenses which can be particularly reimbursed because of the such crisis rescue gives. Unemployment guidance payments within the Operate are taxable unemployment settlement. Come across Jobless settlement under Unemployment Advantages, before.